What are the factors that influence the crypto price change?

The entire world has witnessed the buzz of crypto, but it is not new to market. It has been a decade since crypto is available to the public now, but today it is enjoying relatively more popularity. Due to this people are now aware of digital coins & are investing in it and the process of creating these coins is known as mining. Crypto is considered to be notoriously volatile as its value remains a mystery to a lot of people deemed as outsiders of the cryptocurrency community. Cryptocurrency is based on the idea of decentralisation and for these coins, blockchain technology is playing a vital role in sustaining them and making them secure.

Before getting deep into the factors that influence crypto’s value let’s first know what cryptocurrency is and how it works.

What is cryptocurrency and how does it work?

Cryptocurrency is a digital asset and is known as currency because it was created as a means of exchange just like fiat currency. The whole working of cryptocurrency is based on blockchain technology. All the transactions are internet based and they get recorded in blockchain.

Cryptocurrency is different from fiat currency as it isn’t controlled and regulated by the government. This means that cryptocurrencies are transparent in their transaction history, are portable and inflation resistant (cryptocurrencies will also generally have a fixed supply). Crypto derives its value from the fact that two parties in a transaction put their trust in that value.

Now let’s get into the facts that are responsible for the fluctuation of crypto’s price.

Factors that influence the crypto price change

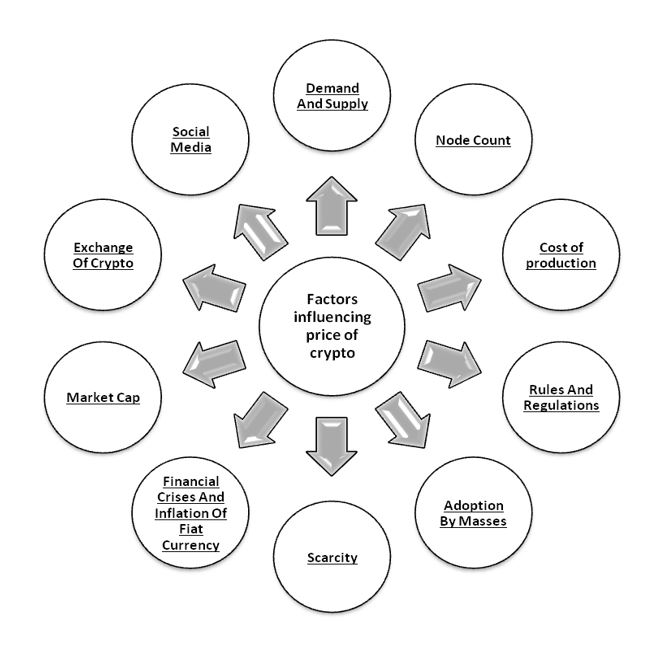

Multiple factors that contribute to change of crypto’s price are:

1. Cryptocurrency’s Demand And Supply

Every commodity that is in the market totally depends on the supply and demand chain and the same is with crypto’s case, its value is determined in the same way. If the demand of cryptocurrency is higher and supply is relatively low then the value of coins will increase. The same case is with Bitcoin as it has a fixed maximum supply of 21 million Bitcoins. Whenever a new block is mined on the blockchain the supply increases in a fixed ratio and due to its popularity its demand is high.

When the demand of digital coins (crypto) is low and supply is more that leads to decrease in value of cryptocurrency. Demand can increase as a project gains awareness or when its utility increases. Wider adoption of a cryptocurrency as an investment can also increase demand.

2. Node Count:

Node count is used as a measure of active wallets existing in the network. Node count is an indicator of how strong the community is. A high node count is proof of a strong community, and a strong community is a proof for that currency to overcome a potential crisis. A large node number can also indicate the strength and decentralisation of a network; it is also a good indicator of the value of a cryptocurrency. To find out whether a currency has a fair price or whether it is overbought, one can search for the node count and the total (market cap) of the cryptocurrency and then comparing the two indicators with other cryptocurrencies.

So it is an important factor that influences the price of crypto.

3. Cost of production

Production cost is one of the most important factors that influence cryptocurrency price. These cryptocurrencies are extracted by miners using special equipment called excavators. The miners use specialised hardware and servers to produce new tokens and verify new network transactions. The decentralised network of miners is what allows cryptocurrency to work as it does.

The miners use expensive technology to extract these coins so when the cost of mining increases, the cryptocurrency value also increases. A proper market research should be conducted by miner’s prior to mining to check its demand so that it can bring in profits.

4. Governments Rules And Regulations:

As it is a well known fact that cryptocurrencies are decentralised and are unregulated. It is not the same case as it’s for fiat currency as it is regulated by central authority. Due to crypto’s non-regulation it is banned in certain countries as governments don’t support these transactions. So there is high demand for regulation of cryptocurrency and if this happens this will result in digital money being centralised and will affect the value of cryptocurrency.

Regulation is required for easier ways to trade cryptocurrency. The easiest way to control the crypto market is addition of taxation in transactions. By these limitations and regulation, the centralisation of virtual currency will increase, thus impacting the price of cryptocurrency. Regulations can also negatively impact demand for cryptocurrency. If the regulations become quite restrictive or take the form of repression, the price of the cryptocurrency may fall down.

5. Adoption By Masses

If an asset gets mass adoption at the same time it also gains significant value. Adoption by masses plays an important role in the demand and supply factor of cryptocurrency. There is a sudden hike in prices when an asset is recognized and in case of crypto because of its limited number, the demand increases which certainly leads to increase in price too.

But there is a real problem associated with this virtual currency that, they cannot be exchanged for goods and services as widely as fiat currency.

6. Scarcity

The scarcity of cryptocurrencies refers to the limited supply of digital coins and currency. Because if there is limited supply, the currency’s price will increase. Meanwhile, if the supply of crypto increases, the prices decrease. Some cryptocurrency projects ‘burn’ current coins by sending them to irretrievable addresses inside the blockchain as this is an indispensible way to control supply. So scarcity plays an important factor that influences the price of crypto.

7. Exchange Of Crypto

If a cryptocurrency becomes listed on more exchanges, it can increase the number of investors willing and able to buy it, thus increasing demand. And, as demand increases, the price goes up. If a person needs two or more exchanges to swap any cryptocurrency token, he will pay a fee for each swap, raising the investment cost. Currency exchange ensures a trust to invest in that particular crypto which will result in change of demand.

8. Social Media

Today’s era is blessed with such a powerful tool known as social media; it can act as an advantage and at the same time can act as a disadvantage. When we talk of the cryptocurrency market, social media can really drive the actions and moods of an investor. The way social media presents crypto affects its demand and prices. A bit of news or posts about crypto have the capacity to increase or decrease the price and holdings.

On social media there is impact created by influential people like, when Elon Musk tweeted about DOGE coin, it influenced its value several times. Social media holds the power to educate people about cryptocurrencies, this helps the public to build greater understanding and desire to have digital currency. You can find the latest social media news in our crypto news aggregator.

9. Market Cap

Market capitalization or market cap is an indicator of market value of that coin. One of the easiest ways to calculate market capitalization is by multiplying the total supply of the coins with the price of each coin:

Let’s consider an example of Coin A and Coin B

| Coin A | Coin B |

| Coins in circulation = 2,00,000 | Coins in circulation = 1,00,000 |

| Price of each coin = Rs. 2 | Price of each coin = Rs. 3 |

| Market Cap = Rs. 4,00,000 | Market Cap = Rs. 3,00,000 |

Even though Coin B is priced more individually, Coin A takes the lead in terms of market cap value. We can conclude that market cap value is a good technique to indicate the true price of a cryptocurrency.

10. Financial Crises And Inflation Of Fiat Currency

The price of cryptocurrency is also influenced by the economic condition of the concerned country. If there is a collapse of the traditional financial system then people can run to other assets. At the time of inflation when the price of fiat currency fluctuates, even Bitcoins can become a much better form of capital security. So, financial crises along with inflation have a strong connection with virtual currency and its prices.

Final Thoughts

Crypto is certainly a very volatile asset, but it gains its value based on the scale of community involvement. Perhaps there are multiple ways in which the value of cryptocurrency can be determined. But there is no fully fledged error free way to predict its prices. So, before investing in crypto, investors should conduct proper market research and consider all the risk involved in it. Crypto is here to stay for a long time, people will invest in blockchain technology and soon the government will be regulating this sector too.